Dow retreated 163 (near session highs with buying in the last hour), decliners over advancers better than 2-1 & NAZ fell 3. The MLP index was off 4+ to 184. Junk bond funds crawled higher & Treasuries were sold, bringing higher yields. Oil declined 2+ to the 63s & gold finished up 1 to 1869 after the FOMC meeting minutes were released (more on both below).

AMJ (Alerian MLP Index tracking fund)

Centers for Disease Control & Prevention data shows 60% of US adults have received at least one

dose of a Covid vaccine. The milestone comes roughly 6 weeks

ahead of Jul 4, the deadline for Pres Biden's latest

vaccination goal of getting 70% of adults to receive one dose or more. US

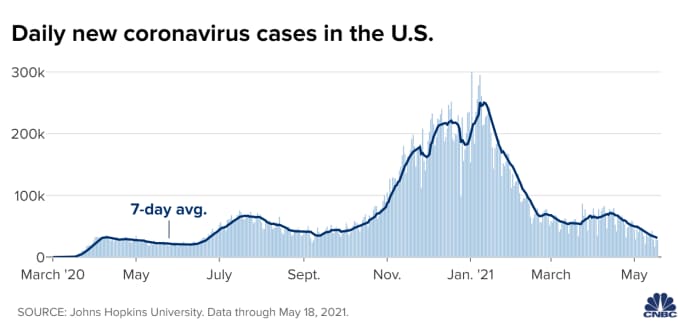

case counts fell further yesterday, with the 7-day average of daily

new cases now at 31K, according to data compiled by Johns

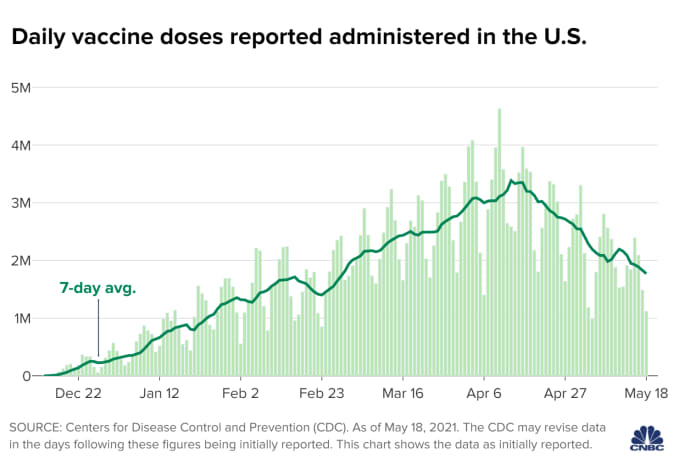

Hopkins University. About 48% of the US population has received one dose or more of a vaccine & 38% is fully vaccinated, according to the CDC. Of those aged 18 & older, 60% are at least partially vaccinated. The country is reporting an average of 1.8M vaccinations per day

over the past week. That figure has been on a mostly

downward trend from its peak level of 3.4M daily shots since mid Apr (shown below).

The latest 7-day average of daily new Covid cases in the US is

31K, according to Hopkins data. That's down 18% from a week prior.

The country was reporting an average of more than 71K cases per day

about a month ago.

India reported its highest single-day increase in Covid-19 deaths as cases stayed below 300K for the 3rd straight day. Today health ministry data showed at least 4529 people succumbed to the disease over a 24-hour period as 267K new cases were registered. India has reported more than 25M cases & over 283K deaths so far. But experts suggest the figures undercount the actual toll as testing is limited in some places, particularly in rural areas currently experiencing a surge in cases. Many patients who have died at home — due to hospitals running out of beds — are also typically left out of the official tally. The South Asian nation has been testing between 1.5-2M samples daily over the last 7 days, according to gov data. The test positivity rate has come down from 19.5% last Thurs to 13.3% today.

India’s daily death toll crosses 4,500 as Covid-19 cases stay below 300,000

Gold prices climbed for a 5th straight session, extending their rise to their highest level in 4 months. Moves for the metal came on the heels of a tumble in bitcoin & as US benchmark stock idexes declined. Minutes from the Federal Reserve's Apr meeting, released after gold futures settled for the session, showed that members of the FOMC agreed that any price increases from bottlenecks are likely to only have “transitory effects” on inflation. Precious metal investors fear that out-of-control inflation could prompt the Fed to rapidly lift benchmark interest rates — a move that would weigh on bullion that doesn't offer a coupon. In electronic trading, Jun gold traded at $1876 an ounce shortly after the Fed minutes were released. Prices for the contract today rose $13 (0.7%) to settle at $1881 an ounce after trading as high as $1891. Prices tallied a 5th straight climb & marked the most-active contract's highest finish in more than 4 months. Buying in gold had been supported by waning appetite for risk & weakness in the $, represented by the popular ICE US Dollar Index hitting a nearly 3-month low. However, today, the buck was rebounding.

Gold extends winning streak to a 5th session as bitcoin tumbles

Federal Reserve officials at their Apr meeting said a strong pickup in economic activity would warrant discussions about tightening monetary policy, according to minutes from the session. “A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases,” the summary stated. Markets have been watching closely for clues about when the central bank might start tapering its bond purchases, which currently are at least $120B a month. The Fed balance sheet is just shy of $7.9T, about double its level prior to the Covid-19 pandemic. Chair Jerome Powell said after the meeting that the recovery remains “uneven and far from complete” & the economy was still not showing the “substantial further progress” standard the committee has set before it will change policy. However, since then the Consumer Price Index showed inflation rising at a 4.2% year over year pace, the GDP is expected to show growth approaching 10% in Q2 & indicators in manufacturing & spending are showing strong upward momentum. The one exception was a stunningly slow pace of hiring in Apr, with nonfarm payrolls rising just 266K against expectations for a 1M gain. The FOMC voted to hold benchmark short-term borrowing rates near zero & to continue buying at least $120B in bonds each month. Along with that decision, the Fed upgraded its view on the economy, saying growth has “strengthened” & inflation was rising. Since then, Fed officials have been united in saying the economy remains at the mercy of the Covid-19 pandemic & they are committed to keeping policy loose.

The Fed hinted it could reconsider easy policies if economy continues rapid improvement

Oil futures end at lowest in over 3 weeks as stocks decline, U.S. crude supplies rise

Dow Jones Industrials

![Live 24 hours gold chart [Kitco Inc.]](https://www.kitco.com/images/live/gold.gif?0.2180338269244485)

No comments:

Post a Comment