Dow crawled up 10, advancers over decliners better than 2-1 & NAZ gained 80. The MLP index added 2+ to the 188s & the REIT index rose 1+ to the 433s (close to record levels in Feb 2020). Junk bond funds were bid higher & Treasuries saw a little selling. Oil inched higher in the 66s & gold was off 2 at 1895 (more on both below).

AMJ (Alerian MLP Index tracking fund)

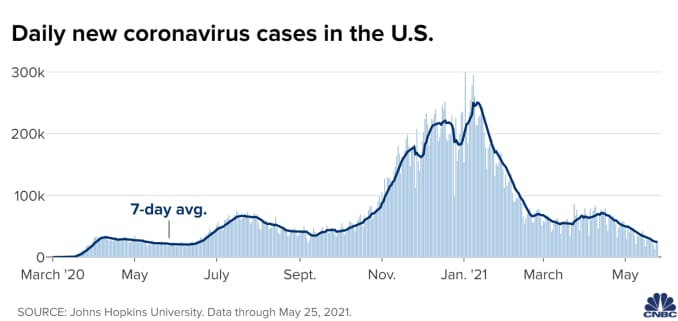

The 7-day average of new US Covid cases fell

further yesterday to 24K infections per day, according to Johns Hopkins University & the average pace of daily

deaths is also on the decline. The latest data from the Centers for Disease Control & Prevention (CDC) shows that ½ of adult Americans are now fully vaccinated against Covid. For those not vaccinated, CDC Director Dr Rochelle Walensky urged

caution over the upcoming Memorial Day holiday, noting that those who

have gotten a shot are protected. “If you are not vaccinated, our

guidance has not changed for you,” Walensky said. “You remain at risk of infection, you still need to

mask and take other precautions.” Last year, US Covid cases rose following the holiday weekend, when there were no vaccines available at the time. The US is reporting about 24K infections per day over

the past week, down 23% from a week ago & a steep decline from the

most recent high point of more than 71K cases per day in mid-Apr.

The US is seeing an average of 520 Covid deaths per day over the last week. The 7-day average of vaccinations administered in the US is 1.8M per day over the past week, according to CDC data. That figure has hovered between 1.7-2M for more than a week.

U.S. Covid cases fall, CDC urges Memorial Day caution for those not vaccinated

Dick' Sporting Goods (DKS) reported fiscal Q1 earnings & revenue topped estimates, saying kids returning to team sports boosted

sales. It also raised its full-year financial outlook, citing building momentum. EPS grew to $3.41 from a

loss of $1.71 per share a year earlier. Excluding

one-time adjustments, EPS was $3.79, well ahead of the $1.12 that was expected. Revenue

grew 119% to $2.9B from $1.3B a year earlier, when

DKS was forced to shut its stores for a period of time due to the

pandemic. That beat estimates for $2.2B & on a 2-year basis,

sales were up 52%. CEO Lauren Hobart said it saw a resurgence in

its team sports business during the qtr, as kids returned to

activities following a year when many youth sports were canceled. The

company also saw heightened demand in the golf category. Same-store sales surged 115% year over year which included e-commerce growth of 14%. Digital sales accounted for 20% of total sales, up from 13% in 2019. DKS

now expects adjusted EPS in fiscal 2021 to be $8.00-8.70, with sales of $10.5-10.8B. Analysts had been looking for EPS of $5.32, after

adjustments, on sales of $9.8B. The stock jumped 14.23 (17%) .

If you would like to learn more about DKS, click on this link:

club.ino.com/trend/analysis/stock/DKS?a_aid=CD3289&a_bid=6ae5b6f7

Dick’s Sporting Goods earnings crush estimates, retailer hikes forecast

Gold futures settled above a price that had been viewed as a point of resistance for bullion for weeks, & turned positive for YTD, perhaps pointing to a near-term bullish outlook for the precious metal. Jun gold climbed by $3 to settle at $1901 an ounce, after a 0.7% gain yesterday. Based on the most-active contracts, today's rise extended a move to the highest settlement since Jan 7. Aug gold, which is also among the most active, settled at $1903 an ounce, up $3. Weakness in the $, particularly against China's yuan which is at its highest in about 3 years, & a retreat in Treasury yields, with the 10-year Treasury note at around 1.57%, have buttressed gold moves. Falling yields can benefit precious metals & other commodities, which don't offer a coupon, by reducing the opportunity cost of holding them against yield-bearing assets. And $ weakness can make assets priced in the currency more attractive to overseas investors. Commodity analysts have made the case that talk from a number of Federal Reserve officials, who have expressed tolerance in the short-term for rising inflation as the economy recovers from the COVID-19 pandemic, has helped to buoy bullion. Gold is headed for a monthly gain of more than 7% & its recent rise has helped it flip into positive territory in 2021, up 0.3%. Bullion's current gains put it on track for its best monthly climb since Jul.

Gold settles above key ‘resistance’ price of $1,900, turns positive for 2021

Oil futures finished higher, as price support from

across-the-board declines in US petroleum inventories outweighed

concerns over the prospects for a return of Iranian crude supplies to

the global market. The Energy Information Administration (EIA) reported that US crude inventories fell by 1.7M barrels last week. The forecast called for a decline of 2.2M barrels for crude stocks, while the American Petroleum Institute yesterday reported a 439K-barrel decline. West Texas Intermediate crude for Jul rose 14¢ to settle at $66.21 a barrel. Front-month Jul Brent crude,

the global benchmark, climbed 22¢ to $68.87 a

barrel. The most active Aug Brent tacked on 24¢ at $68.73 a barrel. The EIA data also showed crude stocks at the Cushing, Okla, storage hub edged down by 1M barrels for the week.

Oil prices finish higher as U.S. crude, gasoline supplies decline

Dow Jones Industrials

![Live 24 hours gold chart [Kitco Inc.]](https://www.kitco.com/images/live/gold.gif?0.2180338269244485)

No comments:

Post a Comment