Dow dropped 14, decliners over advancers 3-2 & NAZ fell a bigger 22. The banks led the selling with the Financial Index falling 1½ to the 207s. The MLP index rose 2½ to the 398s (highest level in more than a month) while the REIT index fell 1 (from the Fri high for 2012) to just below 260. Junk bond funds were in demand as were Treasuries. Oil ended little changed. Gold was also flattish, capping a 3rd straight monthly decline, on concern that demand in India, the world’s biggest buyer, is slowing & after a report showed Spain’s economy entered its 2nd recession since 2009.

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif)

Photo: Bloomberg

US business activity expanded in Apr at the slowest pace since the end of 2009, adding to evidence that manufacturing is cooling. The Institute for Supply Management said its barometer decreased to 56.2, lower than expected, from 62.2 in Mar ((readings greater than 50 signal growth). The pace of production eased in Apr reflecting a recession in Europe & a slowdown in China that may keep holding back orders. Projections were that the gauge would fall to 58-62.9. Household purchases, which account for about 70% of the economy, increased 0.3% in Mar, after a revised 0.9% gain in Feb (stronger than first reported) according to the Commerce Dept. Stronger activity in winter related to the warm weather may take away from business meant for the months in the spring.

Manufacturing Cools Even as U.S. Consumers Still Spend

Photo: Yahoo

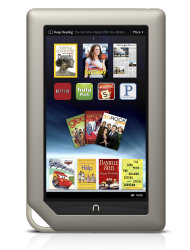

Microsoft, a Dow stock, provided an infusion of money to help Barnes & Noble to compete in the e-book business. It's investing $300M in BKS which sent the stock zooming. The companies are teaming up to create a subsidiary for BKS e-book & college textbook businesses, with MSFT taking a 17.6% stake, giving BKS ammunition to fend off those who asked for a sale of the Nook e-book business or the whole company. Instead, they are exploring separating the subsidiary, provisionally dubbed "Newco," entirely from BKS via a stock offering or sale. For MSFT, the investment means that it will own part of a company that sells tablets based on Google (GOOG) Android, the main competitor of Windows Phone 7 (Microsoft's smartphone software). MSFT also said the deal means that there will be a Nook application for Windows 8 tablets, set to be released this fall. MSFT has a long-standing interest in the e-book field after launching e-book software in 2000, but was never able to build a substantial library of books. It's discontinuing the software on Aug 30. BKS shot up 7.29 to 21.32 ($6 below its high early in the day) & MSFT was up a few pennies.

Barnes & Noble’s Microsoft Deal to Drive Overseas Sales

The average price for gas at the pump is getting less attention after slipping back from recent highs (to be expected when crude pulls back). But it's still only a dime below recent highs & very much at troublesome levels for the economy..

Source: AAA

Source: AAA

Dow was up all of 1 in Apr, not bad considering the great run in Q1. It's up 1K YTD, making the bulls happy. MLPs have been market leaders off the lows 3 years ago but lost that role in 2012. However the rally in the last 5 weeks has put the index in the black YTD & within 13 of its record highs reached 2 months ago. Investors have been bidding up junk bond funds & buying Treasuries in Apr. That's sort of a mixed message when combined with extending the stock market rally. But it looks like there is a slight edge for yield securities (risky & investment grade). Earnings season was only able to allow the markets to recover lost territory, not impressive.

JPMorgan Chase Capital XVI (AMJ)

Click below for the latest market update:

Treasury yields:

U.S. 3-month | 0.092% | |

U.S. 2-year | 0.258% | |

U.S. 10-year | 1.910% |

| CLM12.NYM... | Crude Oil Jun 12 | ...104.79 | ... | (0.1%) |

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif)

US business activity expanded in Apr at the slowest pace since the end of 2009, adding to evidence that manufacturing is cooling. The Institute for Supply Management said its barometer decreased to 56.2, lower than expected, from 62.2 in Mar ((readings greater than 50 signal growth). The pace of production eased in Apr reflecting a recession in Europe & a slowdown in China that may keep holding back orders. Projections were that the gauge would fall to 58-62.9. Household purchases, which account for about 70% of the economy, increased 0.3% in Mar, after a revised 0.9% gain in Feb (stronger than first reported) according to the Commerce Dept. Stronger activity in winter related to the warm weather may take away from business meant for the months in the spring.

Manufacturing Cools Even as U.S. Consumers Still Spend

Photo: Yahoo

Microsoft, a Dow stock, provided an infusion of money to help Barnes & Noble to compete in the e-book business. It's investing $300M in BKS which sent the stock zooming. The companies are teaming up to create a subsidiary for BKS e-book & college textbook businesses, with MSFT taking a 17.6% stake, giving BKS ammunition to fend off those who asked for a sale of the Nook e-book business or the whole company. Instead, they are exploring separating the subsidiary, provisionally dubbed "Newco," entirely from BKS via a stock offering or sale. For MSFT, the investment means that it will own part of a company that sells tablets based on Google (GOOG) Android, the main competitor of Windows Phone 7 (Microsoft's smartphone software). MSFT also said the deal means that there will be a Nook application for Windows 8 tablets, set to be released this fall. MSFT has a long-standing interest in the e-book field after launching e-book software in 2000, but was never able to build a substantial library of books. It's discontinuing the software on Aug 30. BKS shot up 7.29 to 21.32 ($6 below its high early in the day) & MSFT was up a few pennies.

Barnes & Noble’s Microsoft Deal to Drive Overseas Sales

Barnes & Noble, Inc. (BKS)

Microsoft Corporation (MSFT)

The average price for gas at the pump is getting less attention after slipping back from recent highs (to be expected when crude pulls back). But it's still only a dime below recent highs & very much at troublesome levels for the economy..

Dow was up all of 1 in Apr, not bad considering the great run in Q1. It's up 1K YTD, making the bulls happy. MLPs have been market leaders off the lows 3 years ago but lost that role in 2012. However the rally in the last 5 weeks has put the index in the black YTD & within 13 of its record highs reached 2 months ago. Investors have been bidding up junk bond funds & buying Treasuries in Apr. That's sort of a mixed message when combined with extending the stock market rally. But it looks like there is a slight edge for yield securities (risky & investment grade). Earnings season was only able to allow the markets to recover lost territory, not impressive.

Get your favorite symbols' Trend Analysis TODAY!