Dow rose 37, advancers ahead of decliners 3-2 & NAZ lost 27. The MLP index slid back 1+ to the 336s & the REIT index was little changed. Junk bond funds fluctuated & Treasuries rose. Oil went up again, to the 47s, & gold also climbed higher.

AMJ (Alerian MLP Index tracking fund)

Asian stocks extended gains, heading for the biggest 5-day gain in nearly 4 years, amid speculation that global central bank policies will remain accommodative to counteract weak economic growth. The MSCI Asia Pacific Index increased 0.7% to 128, extending its 5-day gain to 6.4%. Japan’s Topix index rose 0.8% after the ¥ weakened 0.5%, taking gains over a 5-day period to 7.3%. Prime Minister Shinzo Abe’s efforts to push thru structural changes to recharge Japan’s economy got a boost as negotiators reached a deal on a Pacific trade pact that would create the world’s biggest regional trade zone. The Trans-Pacific Partnership still needs to be ratified by lawmakers in the 12 member nations. Hong Kong’s Hang Seng Index fell 0.1%, while the Hang Seng China Enterprises Index of mainland firms listed in the city added 0.5%. Mainland Chinese markets remain closed for a holiday.

Stocks needed to take a breather after the recent run which was probably overdone. The outlook from the IMF is another indication that all is not well around the globe. And then there is earnings season which will supply a lot of reports by next week. Markets should be nervous about what they will say.

Dow Jones Industrials

AMJ (Alerian MLP Index tracking fund)

| CLX15.NYM | ...Crude Oil Nov 15 | ...46.77 | (1.1%) |

| GCV15.CMX | ...Gold Oct 15 | ......1,147.40 | (0.8%) |

The global economy is having power problems. A slowdown in emerging

markets driven by weak commodity prices forced the IMF to cut its outlook for global growth this year to 3.1% from a Jul forecast of 3.3%. Next year the world economy

will expand 3.6%, less than the 3.8% projected in Jul “The ‘holy grail’ of robust and synchronized global expansion remains elusive,” IMF chief economist Maurice Obstfeld said. 6 years after the world emerged from a financial crisis & recession, the deteriorating

picture showed a global recovery that’s uneven still from Australia to

Germany. Brazil & Russia’s economies are contracting, Japan & the

euro area are struggling to impress, & long-time growth engine China

is decelerating. Meanwhile, the US economy is nearly strong enough for

central bankers to consider raising interest rates. The IMF advised emerging markets to be ready for the US to tighten monetary

policy, urged advanced economies to address “crisis legacies” &

suggested nations consider the “compelling” case for public

infrastructure investment at a time of very low long-term interest

rates. “In the

near term, global growth will remain moderate and uneven, with higher

downside risks than were apparent at our July update,” Obstfeld said. The

fund left its outlook for China’s growth this year at 6.8% &

6.3% for next year. Still, the IMF said the “cross-border

repercussions” of slowing Chinese growth “appear greater than previously

envisaged.” The modest recovery among

advanced economies, led by the US & UK will likely continue,

though the world’s richest nations will remain threatened by

deflationary pressures. The US will expand at a

2.6 % pace this year, up from a forecast of 2.5% in Jul & the economy will accelerate to

2.8% growth next year, down from a projected 3% in Jul. Monetary policy should remain loose where

output gaps remain, & countries should increase public spending in

areas such as infrastructure where fiscal pace permits.

The report illustrates “the challenges all countries face, and it places

even more importance on the policy upgrades that all require,” Obstfeld

said.

IMF Cuts Global Outlook as Commodity Slump Hits Emerging Markets

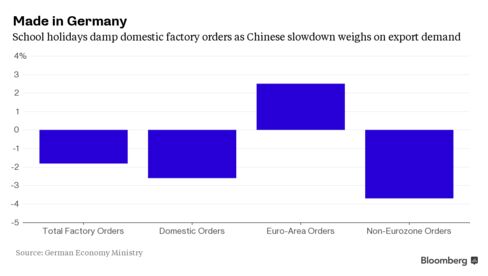

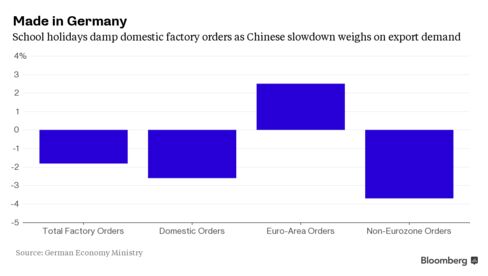

German factory orders

unexpectedly fell in Aug in a sign that Europe’s largest economy is

vulnerable to weaker growth in China & other emerging markets. Orders,

adjusted for seasonal swings & inflation, dropped 1.8% after

decreasing a revised 2.2% in Jul, data from the Economy Ministry. The typically volatile number compares

with an estimate of a 0.5% increase.

Orders rose 1.9% from a year earlier. A China-led slowdown

in emerging markets that threatens Germany’s export-oriented economy is

exacerbated by an emissions scandal at Volkswagen that could affect

as many as 11M cars globally. Still, business confidence

unexpectedly increased in Sep as the economy benefited from

strengthening domestic demand on the back of record employment, rising

wages & low inflation.

Excluding big-ticket items, orders dropped 2.1% in Aug, the Economy Ministry said. Domestic factory orders declined 2.6% as demand for investment goods slumped. The drop in orders was exaggerated by school holidays. A bright spot was the rest of the euro area, where demand for capital goods jumped. Aug factory orders don’t yet reflect the impact of VW’s cheating on US emissions tests revealed last month. Chairman-designate Hans Dieter Poetsch warned that the scandal could pose “an existence-threatening crisis” for Europe’s largest carmaker, which is exploring options from a simple software upgrade to outright replacement of cars as a deadline approaches to present a fix for rigged diesel vehicles.

Excluding big-ticket items, orders dropped 2.1% in Aug, the Economy Ministry said. Domestic factory orders declined 2.6% as demand for investment goods slumped. The drop in orders was exaggerated by school holidays. A bright spot was the rest of the euro area, where demand for capital goods jumped. Aug factory orders don’t yet reflect the impact of VW’s cheating on US emissions tests revealed last month. Chairman-designate Hans Dieter Poetsch warned that the scandal could pose “an existence-threatening crisis” for Europe’s largest carmaker, which is exploring options from a simple software upgrade to outright replacement of cars as a deadline approaches to present a fix for rigged diesel vehicles.

German Factory Orders Unexpectedly Fall Amid Economic Risks

Asian stocks extended gains, heading for the biggest 5-day gain in nearly 4 years, amid speculation that global central bank policies will remain accommodative to counteract weak economic growth. The MSCI Asia Pacific Index increased 0.7% to 128, extending its 5-day gain to 6.4%. Japan’s Topix index rose 0.8% after the ¥ weakened 0.5%, taking gains over a 5-day period to 7.3%. Prime Minister Shinzo Abe’s efforts to push thru structural changes to recharge Japan’s economy got a boost as negotiators reached a deal on a Pacific trade pact that would create the world’s biggest regional trade zone. The Trans-Pacific Partnership still needs to be ratified by lawmakers in the 12 member nations. Hong Kong’s Hang Seng Index fell 0.1%, while the Hang Seng China Enterprises Index of mainland firms listed in the city added 0.5%. Mainland Chinese markets remain closed for a holiday.

Asian Stocks Advance to Post Biggest Five-Day Rally Since 2011

Stocks needed to take a breather after the recent run which was probably overdone. The outlook from the IMF is another indication that all is not well around the globe. And then there is earnings season which will supply a lot of reports by next week. Markets should be nervous about what they will say.

Dow Jones Industrials

No comments:

Post a Comment