Dow soared 247 (closing near the highs), advancers over decliners 3-1 & NAZ gained 89 to go over 5K once again. The MLP index was up 1+ to the 313s & the REIT index rose 3+ to 317. Junk bond funds crawled higher & Treasuries weakened. Oil had a modest gain after weekly data showed a smaller than expected rise in US crude inventories but an unexpected rise in gasoline stocks & gold edged higher.

AMJ (Alerian MLP Index tracking fund)

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif?0.7346286569606029)

Federal Reserve officials continued to flag Dec as a possible time to raise interest rates after years near zero, with 2 expressing confidence they will be able to pull it off smoothly despite fears of an abrupt market reaction. Cleveland Fed pres Loretta Mester repeated her position that the US economy is now strong enough to absorb a modest policy tightening. Atlanta Fed pres Dennis Lockhart said global financial markets have settled since the Aug turmoil that caused the central bank to delay raising rates. "I am now reasonably satisfied the situation has settled down ... So I am comfortable with moving off zero soon, conditioned on no marked deterioration in economic conditions," Lockhart said. "I believe it will soon be appropriate to begin a new policy phase," he said, adding he will monitor economic data between now & the Dec meeting. The comments were the latest in a string of communications from officials meant to encourage global markets to prepare for the first rate hike in nearly a decade. The policy change is expected to accelerate an ongoing market direction of strengthening the US dollar & sucking funds from emerging markets.

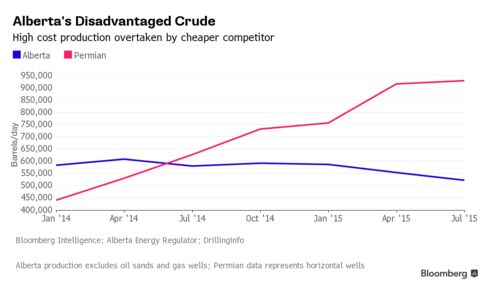

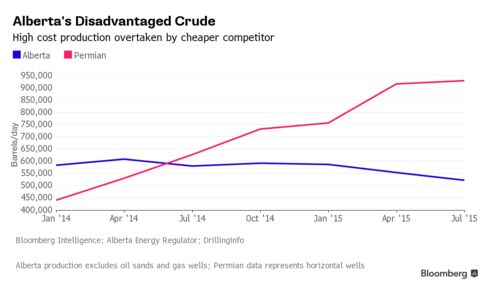

OPEC took a swing at U.S. shale and knocked down Canada. Threatened by surging production from North America, OPEC has been pumping above its quota for 17 months as it seeks to take market share from higher-cost regions. The resulting 60% price crash is hitting Alberta harder than Texas. Canadian producers are struggling to cut the cost of extracting bitumen from the oil sands, & their other wells are failing to match the efficiency gains of US rivals. While output keeps rising in the Permian Basin, the largest US shale play, companies are slowing output from wells in Alberta & have shelved 18 oil-sands projects during the downturn.

In a policy shift a year ago, the cartel decided against propping up oil prices, keeping its output target at 30M barrels a day even as the supply glut worsened. It has exceeded that ceiling since Jun 2014 & pumped 32.2M barrels a day in Oct. In Alberta, high extraction costs & oil price discounts relative to global benchmarks are poised to continue crimping output. Production, excluding bitumen extraction, dropped about 13% this year thru Jul. That compares with a roughly 19% increase in output from Permian wells over the same period. US crude has plummeted from a $107 closing high on Jun 20 of last year to just above $40 a barrel. The Canadian heavy-oil benchmark is trading at about $15 less than that.

OPEC Targets U.S. Shale, But Hits Canada Instead

Stocks are adjusting to the likelihood of a rate hike next month. There may be a realization that the economic world may not come to an end following the first rate hike (of 25 basis points) in years. Traders are feeling bullish as they ignore the war France has declared on ISIS after it declared war on the rest of the world. Rising optimism ignores this reality & it can prove significant if conflicts worsen. The Dow is back in the black in Nov following its whopper rise last month. I am cautious towards stocks.

Dow Jones Industrials

AMJ (Alerian MLP Index tracking fund)

| CLZ15.NYM | ....Crude Oil Dec 15 | ....40.61 | (0.2%) |

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif?0.7346286569606029)

Federal Reserve policy makers inserted language into the Oct

statement to stress that “it may well become appropriate” to raise the

benchmark lending rate in Dec & largely agreed that the pace of

increases would be gradual, minutes of the meeting showed. “Members emphasized that this change was intended to convey the sense

that, while no decision had been made, it may well become appropriate

to initiate the normalization process at the next meeting,” said minutes

of the FOMC Oct meeting. A majority have signaled they expect to raise

interest rates this year for the first time since 2006. That message was

underscored when policy makers inserted a reference to the “next

meeting” on Dec 15-16 in the Oct statement, in connection with

their assessment on when to act. A “couple” of voting policy makers had qualms that the wording change

“could be misinterpreted as signaling too strongly the expectation” for

Dec liftoff. Participants “generally agreed,” the minutes said,

“that it would probably be appropriate to remove policy accommodation

gradually.” “It was noted that the beginning of the normalization process

relatively soon would make it more likely that the policy trajectory

after liftoff could be shallow.” Policy makers are in 3 camps,

with some saying economic conditions necessary for tightening policy

“had already been met,” while “most participants” estimated that their

criteria “could well be met” in Dec. “Some others, however, judged it unlikely that the information

available by the December meeting would warrant” a rate increase. Economic data since the meeting have been encouraging. Employers

added 271K to payrolls in Oct, the biggest gain this

year, & unemployment fell to 5%. Job openings in Sep

climbed to the 2nd highest on record, while the consumer price index,

minus food & energy, rose 1.9% last month from a year earlier.

Fed Inserted Language to Stress Potential for December Liftoff

Federal Reserve officials continued to flag Dec as a possible time to raise interest rates after years near zero, with 2 expressing confidence they will be able to pull it off smoothly despite fears of an abrupt market reaction. Cleveland Fed pres Loretta Mester repeated her position that the US economy is now strong enough to absorb a modest policy tightening. Atlanta Fed pres Dennis Lockhart said global financial markets have settled since the Aug turmoil that caused the central bank to delay raising rates. "I am now reasonably satisfied the situation has settled down ... So I am comfortable with moving off zero soon, conditioned on no marked deterioration in economic conditions," Lockhart said. "I believe it will soon be appropriate to begin a new policy phase," he said, adding he will monitor economic data between now & the Dec meeting. The comments were the latest in a string of communications from officials meant to encourage global markets to prepare for the first rate hike in nearly a decade. The policy change is expected to accelerate an ongoing market direction of strengthening the US dollar & sucking funds from emerging markets.

Lockhart: Calm Markets Should Spur Fed to Hike

OPEC took a swing at U.S. shale and knocked down Canada. Threatened by surging production from North America, OPEC has been pumping above its quota for 17 months as it seeks to take market share from higher-cost regions. The resulting 60% price crash is hitting Alberta harder than Texas. Canadian producers are struggling to cut the cost of extracting bitumen from the oil sands, & their other wells are failing to match the efficiency gains of US rivals. While output keeps rising in the Permian Basin, the largest US shale play, companies are slowing output from wells in Alberta & have shelved 18 oil-sands projects during the downturn.

In a policy shift a year ago, the cartel decided against propping up oil prices, keeping its output target at 30M barrels a day even as the supply glut worsened. It has exceeded that ceiling since Jun 2014 & pumped 32.2M barrels a day in Oct. In Alberta, high extraction costs & oil price discounts relative to global benchmarks are poised to continue crimping output. Production, excluding bitumen extraction, dropped about 13% this year thru Jul. That compares with a roughly 19% increase in output from Permian wells over the same period. US crude has plummeted from a $107 closing high on Jun 20 of last year to just above $40 a barrel. The Canadian heavy-oil benchmark is trading at about $15 less than that.

OPEC Targets U.S. Shale, But Hits Canada Instead

Stocks are adjusting to the likelihood of a rate hike next month. There may be a realization that the economic world may not come to an end following the first rate hike (of 25 basis points) in years. Traders are feeling bullish as they ignore the war France has declared on ISIS after it declared war on the rest of the world. Rising optimism ignores this reality & it can prove significant if conflicts worsen. The Dow is back in the black in Nov following its whopper rise last month. I am cautious towards stocks.

Dow Jones Industrials

No comments:

Post a Comment