Dow edge up 25, advancers continued slightly ahead of decliners & NAZ was up 19. The MLP index added 2+ to the 194s & the REIT index advanced 5+ to the 449s for a new record. Junk bond funds remained mixed & Treasuries were bid higher. Oil climbed almost 1 to the high 68s & gold rose 5 to 1910 (more on both below).

AMJ (Alerian MLP Index tracking fund)

The size of Pres Biden's proposed budget for fiscal year 2022: $6T. Major spikes in spending for almost everything: Health care. Climate change. Education. Infrastructure. This plan would boost overall spending to the highest sustained level not seen since WW-II. Debt would outpace the nation's GDP by 117% in a decade. This is on top of the Ts of $s Congress allocated last year & over the winter to combat the pandemic. And it has nothing at all to do with potentially spending $1.7T on infrastructure, as proposed by Pres Biden. Here a couple of things to remember about budgets sent to Congress by presidents: Budgets are aspirational. Press releases on steroids. Phantoms. If we had a king & not a pres, Biden would spend $6T in fiscal year 2022, down to the nickel as outlined in his budget. There would be no "budget request." After all, the Constitution is clear that the exec branch doesn't decide how much money the gov spends. The power of the purse resides with the legislative branch. This is why a budget is a "request." Not an actual document that denotes spending. Take a look at Article I, Section 9 of the Constitution: "No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law." In fact, American pres's didn't even have to lay this all out with a budget request until the mid-1970s. Dems in Congress didn't like how Pres Nixon "impounded" money in the 1970s, refusing to spend some of it, despite congressional direction. The Constitution says Congress determines how much money the gov expends. But it's up to the exec branch to actually send it out the door. In 1974, Congress approved The Budget Act. Congress wanted to better track how the exec branch spent the money appropriated by lawmakers. So, Congress required the pres to submit to Congress a budget blueprint, outlining all of his spending priorities. Budgets do not become law. And Congress never adopts a "budget resolution" that mirrors what the pres submitted to Capitol Hill. In fact, sometimes Congress doesn't even approve an overall budget for a given fiscal year. Budgets are ballpark blueprints for spending. Fiscal spit-balling. Yet on Fri & over the weekend, lawmakers from both sides of the aisle & journalists exhausted excessive verbiage on something that doesn't have the force of law & really is just a big idea sheet. Pres Biden proposed scads of new spending, which the left embraced & the right abhorred. But much of the money that the federal gov will spend in fiscal year 2022 is already on autopilot. Around 70% of all federal spending is on cruise control, devoted to entitlements: Medicare, Medicaid, Social Security & interest on the national debt "mandatory spending." That's because Congress, long ago, passed bills to automatically spend money on these popular programs – without an annual appropriation. In other words, it's "mandatory" that the gov spend this money. People may complain about how much DC spends. But most Americans embrace nearly every cent of the "mandatory" spending primed to go out the door, whether Pres Biden placed it in his budget or not. It had to be there since it’s mandatory.

Biden's budget proposal: What to know

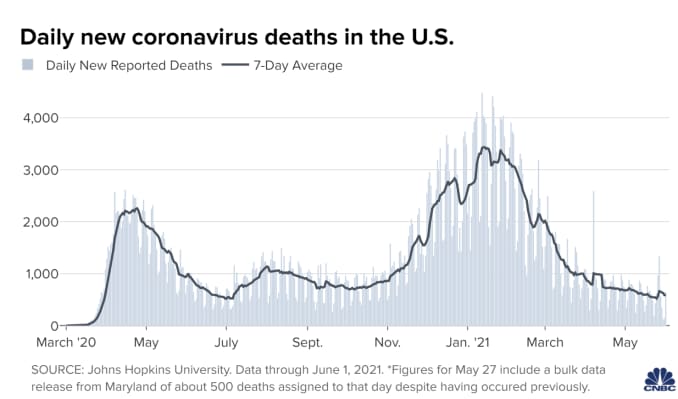

12 states now have 70% of adult residents who have had at least one Covid vaccine shot, Centers for Disease Control & Prevention (CDC) data published yesterday shows. California & Maryland most recently reported crossing the milestone, joining Vermont, Hawaii, Massachusetts, Connecticut, Maine, New Jersey, Rhode Island, New Mexico, Pennsylvania & New Hampshire. Pres Biden has set a goal of having one shot or more administered to 70% of those 18 & older by Jul 4. The 7-day average of daily US infections remained below 20K for the 2nd straight day yesterday, though many states did not publish data over the Memorial Day holiday & may still be catching up on reporting. CDC data shows that 51% of Americans have received at least one dose & about 41% are fully vaccinated. The US is reporting an average of 1.2M vaccinations per day over the past week. The latest 7-day average of US Covid cases is 17K, Johns Hopkins University data shows. But many states did not report data on Memorial Day & cases may tick upward in the coming days to reflect the clearing of backlogs. Prior to the holiday weekend, case counts had been on a downward trajectory for weeks. Also impacted by the holiday weekend reporting slowdown, the current 7-day average of Covid deaths in the US is 589.

Gold futures edged higher to reclaim their highest settlement since early Jan, on the back of a slide in yields for US gov debt, as investors awaited a monthly report on US nonfarm payrolls due at the end of the week. Gold for Aug edged up by $4 to settle at $1909 an ounce, following a tiny slip yesterday. Prices for the most-active contract, which scored a gain of nearly 8% in May, settled at their highest since early Jan. The moves for bullion today came as the benchmark 10-year Treasury yield was at 1.60%, off 2 basis points. Lower bond yields can reduce the opportunity costs of owning precious metals which don't offer a coupon. However, moves in gold were checked by a rise in the $. A stronger $ can make assets priced in the monetary unit more expensive to overseas buyers. Market participants have vacillated between greater confidence that the economy will show a healthy recovery from the COVID pandemic & fears that the economy may run too hot for the Fed to manage. Against that backdrop, some strategists predict that gold may remain rangebound until the Fri report on the US employment situation in May, which could serve as a cross-asset catalyst, especially after Apr's report showed that the US added 266K jobs on the month, far fewer than the roughly 1M that had been forecast by most economists.

Gold prices reclaim highest settlement since January

The US economy grew at a faster rate in Apr & May than earlier in the year, according to the Federal Reserve’s latest Beige Book report. The economy expanded overall at a “moderate pace,” the report found. Consumer spending picked up as a result of increased coronavirus

vaccination rates. Manufacturing activity increased despite notable

supply chain challenges. Inflation pressures continued to build as both

input & selling prices moved higher. Firms

were adding to staff at a steady pace. Some companies reported it was

difficult to find low-wage hourly workers. In some cases, this led some

businesses to reduce their hours of operation. There were reports of record traffic at East Coast ports. The economy appears to be on an upward growth trajectory but perhaps

not at the “boom” level that many economists talk about. Still,

Americans are taking advantage of their newfound freedom to eat out &

travel. There were widespread

reports of labor shortages. In St Louis, a job fair held by a dozen

restaurants to find 100 workers drew barely a dozen applicants. However,

companies appeared reluctant to raise pay packages. The Minneapolis Fed

reporter that wage growth remained below 3% on an annualized basis. Firms in Atlanta thought that labor shortages would abate this fall. A

manufacturing firm in the Boston region had an ambitious goal of hiring

10K workers.

Fed's Beige Book sees pickup in U.S. economic growth

Oil futures climbed sharply, with US prices at their highest in over 2½ years. The Energy Information Administration will release its weekly supply report tomorrow, a day later than usual because of Mon's Memorial Day holiday. Oil prices, however, appeared to gain more ground during the session following reports of a fire at a state-owned refinery in Iran. That followed news that the largest warship in Iran's navy caught fire & sank today. West Texas Intermediate oil for Jul delivery climbed $1.11 (1.6%) to settle at $68.83 a barrel. Front-month contract prices ended at their highest since Oct 2018.

U.S. oil futures post another finish at the highest since 2018

Stocks continue to meander while safe haven gold is on the rise. Cautious investors are nervous about a rise for inflation with a massive increase in gov spending. The Dow was strong iin the morning, then backed off to break-even in the PM.

Dow Jones Industrials

![Live 24 hours gold chart [Kitco Inc.]](https://www.kitco.com/images/live/gold.gif?0.2180338269244485)

No comments:

Post a Comment