S&P 500 FINANCIALS INDEX

| Value | 216.71 | |

| Change | -1.67 (-0.8%) |

The Alerian ML:P Index was up a small fraction in the 364s while the REIT index fell a fraction to 222. Junk bond funds were mixed to higher. Treasuries rallied on growing worries about European debts, especially Portugal. The yield on the 10 year Treasury bond fell 4 basis points to 3.29%, but still in a sideways range for the last month.

Treasury yields:

| U.S. 3-month | 0.13% | |

| U.S. 2-year | 0.58% | |

| U.S. 10-year | 3.29% |

Alerian MLP Index ---- 2 weeks

Dow Jones REIT Index ---- 2 weeks

10-Year Treasury Yield Index ---- 2 weeks

Cold weather is bringing out buyers for oil while gold is marking time, trying to assess sovereign debt issues.

| CLG11.NYM | ...Crude Oil Feb 11 | ...89.14 | ... | (1.3%) |

| GCF11.CMX | ...Gold Jan 11 | .......1,369.50 | ... | (0.1%) |

Gold Super Cycle Link! Click Here

Verizon Wireless, a partially owned sub of Verizon (VZ, a Dow stock), is unveiling its iPhone this week, hoping to shift the landscape in the wireless industry. That should boost sales for Apple (AAPL) as it competes for customers against Google (GOOG) & Research In Motion (RIM). Verizon Wireless, the largest US mobile-phone carrier, will introduce its iPhone tomorrow & begin selling the device later in the month. It is forecasted that VZ may sell 13M iPhones in 2011, related to pent-up demand from existing customers. AAPL gets about $400 per phone & if VZ sells 13M units next year that would give APPL an additional $5B in revenue (which compares worth.total revenue of $65B in the latest fiscal year). However competition from the Droid franchise is growing. Last week, ComScore said Android topped the iPhone in US smartphone subscribers for the first time, accounting for 26% of the market, compared with 25% for AAPL. BlackBerry from RIM had the top spot with 33½%. VZ was up a dime & AAPL gained 3½ to the 339s, a new record high!

Verizon Wireless IPhone to Help Apple Boost Sales, Combat Google and RIM

Verizon --- 1 year

Apple --- 1 year

Photo: Yahoo

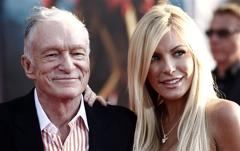

Playboy (PLA) sweetened the offer by founder Hugh Hefner to take the company private at a price of $6.15 a share, 18% above the Fri closing & values the company at over $200M. The bid tops a previous offer of $5.50 per share made last Jul. PLA climbed 88¢ to $6.08. Hefner is the largest shareholder with about 70% of the voting shares & 28% of the nonvoting stock. The company's magazine has struggled with competition from the web, losing readers & advertisers. In Nov it reported a wider Q3 loss than in the prior year as revenue fell 7% to $52M. PLA management has been trying to transform the company from a publishing & TV business into a "brand management" company, leaning more on revenue from licensing out the Playboy name & a range of products. Directors recommend the deal to stockholders. "I believe this agreement will give us the resources and flexibility to return Playboy to its unique position and to further expand our business around the world," Hefner said. The tender offer is expected to begin Jan 21 & expected to close by the end of Q1.

Playboy Agrees to Hefner's Offer to Go Private at $6.15 a Share

Playboy --- 1 year

Buyout news & the VZ deal for APPL are good news which should lave lifted stocks. But they didn't. Sovereign debt problems are weighing heavily on the markets. Earnings season begins this evening when Alcoa (AA), a Dow stock, reports. After the opening minutes of trading on day one of the new year (& decade), markets have been very soggy.

Dow Jones Industrials ---- 2 weeks

Find out what's inside Trend TV

Get your favorite symbols' Trend Analysis TODAY!

No comments:

Post a Comment