S&P 500 Financials Sector Index

| Value | 199.93 | |

| Change | -0.49 (-0.2%) |

MLPs & REITs had a good day with each index up 2+. Junk bond funds inched higher & Treasuries rose a little after a good week for 3, 10 & 30 year bond offerings. Oil rose, trimming a weekly loss, on bets that US fuel consumption may climb amid signs of improving confidence & manufacturing growth. Gold climbed for a 9th straight day amid concern the US is getting closer to losing its top credit rating.

Alerian MLP Index

| Value | 373.09 | |

| Change | 2.58 (0.7%) |

Click below for the latest market update:

Treausry yields:

U.S. 3-month | 0.005% | |

U.S. 2-year | 0.351% | |

U.S. 10-year | 2.906% |

| CLQ11.NYM | ...Crude Oil Aug 11 | ...97.31 | ... |

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif)

Photo: Yahoo

The President & Reps traded demands for a serious deficit plan, as an acrimonious stalemate deepened in negotiations to avert a looming gov default. Reps said they would vote next week on a bill to raise the debt ceiling by the $2.4T Obama has requested as long as Congress adopts a balanced budget amendment -- an unlikely prospect. The measure will consume much of next week. Swell!! Back & forth, back & forth, without anything getting done & the clock keeps ticking. This will probably go down to the wire in early Aug & then only a temp bill which will allow the gov to limp along without resolving the major issues.

Obama, Republicans Trade Demands for Debt Plan- Reuters

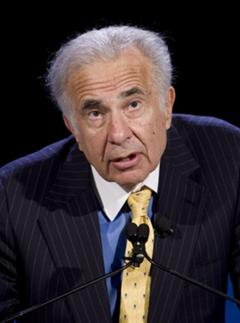

Carl Icahn

Photo: Yahoo

Carl Icahn made an unusual offer to buy Clorox, a Dividend Aristocrat, for $76.50 per share in cash, presenting himself almost as a disinterested bidder & encouraging the company to try to find a better offer. The offer is valued at $12.6B ($10.2B in cash, plus taking on debt & other costs). CLX said the board is "committed to acting in the best interests of our company and our shareholders." Icahn is already the biggest shareholder, after spending nearly $800M to buy a 9.4% stake in Dec. Icahn seems more interested in drumming up other buyers than actually buying CLX himself. If no other bidders stepped forward, Icahn said "our fellow stockholders" should have the opportunity to vote on the Icahn bid. The stock rose 6.12 to 74.55 (but 55¢ below the high).

Icahn makes $10.2B offer for CloroxAP

Clorox Company (The) (CLX)

First Horizon National, a medium size bank, reported its profit surged in Q2, as the size of the lender's loan loss reserves declined sharply from last year. EPS was 16¢ compared with a penny last year & forecasts of 11¢. Revenue fell to $361.6M, from $426M, as net interest income declined to $172.9M from $182.1 last year. The quality of its loan portfolio has been improving, as both loans behind in payments & net loan charge-offs (loans written off as unpaid), declined on an annual & qtr-to-qtr basis. As a result, the provision against loan losses remained at $1M, unchanged from Q1, but well below the $70M in Q2 of 2010. Net charge-offs were 14% lower than in Q1 & 50% lower than a year earlier. The low priced stock, which had been a Dividend Aristocrat before the financial meltdown, was up 12¢.

First Horizon's 2nd-quarter profit surges AP

First Tennessee National Corporation (FHN)

The lack of respect bank earnings reports are getting is telling. While these reports have swirling winds within them giving somewhat mixed signals, on balance they were favorable. But stockholders did not see buying. Dow retreated almost 180 this week which may be an indication of how earnings season will go. Unsettled conditions in DC are unnerving for all. A bit of good news, Enterprise Products (EPD), the largest MLP, declared its 28th consecutive distribution increase, bringing the annual rate to $2.42. The units were up 20¢ to 43.01. More earnings reports are coming next week, but DC talks will dominate the markets.

Dow Industrials (INDU)

Get your favorite symbols' Trend Analysis TODAY!

Find out what's inside Trend TV

No comments:

Post a Comment