Dow gained 165, advancers over decliners better than 3-1 & NAZ went up 32. The MLP index vaulted 10+ to the 274s (up 26 in just 6 days) & the REIT index added 1+ to the 321s. Junk bond funds were higher & Treasuries were sold. Oil gained but the price is not shown below & gold dropped.

AMJ (Alerian MLP Index tracking fund)

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif?0.17568512086796462)

Royal Dutch Shell cut its planned capital spending for 2016 by $2B, to $33B, continuing to cope with low oil prices as it moves to complete its acquisition of BG Group early next year The spending announcement came as the Anglo-Dutch oil company published several key documents in preparation for the main remaining hurdle to the deal: a shareholder vote. In the months since the deal was announced, some investors have expressed concerns about its cost in the face of tumbling oil prices, an issue RDS-B management has been at pains to address. Shell has already taken action to cut costs & reduce spending this year by $12B. "The combination with BG represents a tremendous opportunity to create value for both sets of shareholders, particularly in deep water and [liquefied natural gas]," Shell CEO said. It is "a strong platform to refocus the company, to create a simpler & more competitive Shell." Shell said the tie-up would bolster its position in liquefied natural gas & offshore Brazil, boosting its production & providing it with a clear focus for the coming years. The company expects the deal to enhance its ability to cover investment & divs in "any reasonably expected oil-price environment." Shell estimated that the long-term oil price needed for the deal to break even is in the low-$60s-a-barrel range. Though well above the current price, few expect oil to remain at its current weak levels in the years ahead. The company expects the deal to contribute to its cash flow from operations next year if benchmark Brent crude, now around $36 a barrel, trades at $50 or higher. Shell valued the cash-&-share deal at $53B last week, a sharp decrease compared with the $70B price tag when first announced in Apr. Shell & BG will hold meetings on in late Jan for shareholders approval & the deal could complete by Feb 15. RDS-B stock rose 1.02. If you would like to learn more about RDS-B, click on this link:

club.ino.com/trend/analysis/stock/RDS.B?a_aid=CD3289&a_bid=6ae5b6f7

Nike, a Dow, stock hovered near its all-time high as executives prepared to announce earnings for its fiscal Q2 of 2016. Analysts expect the to meet expectations of another strong performance & remain on track to hit its target of $50B in revenue by 2020. NKE is projected to post EPS of 86¢, an increase of 16% from the same period one year ago, on quarterly revenue of $7.8B. Revenue is expected to rise 5.8% from the 2nd fiscal qtr of 2015. The company has beaten analyst earnings estimates for 13 straight qtrs. NKE has been the best-performing stock in the Dow Jones for 2015, posting a 35% gain. The stock rose 2.05. If you would like to learn more about NKE, click on this link:

club.ino.com/trend/analysis/stock/NKE?a_aid=CD3289&a_bid=6ae5b6f7

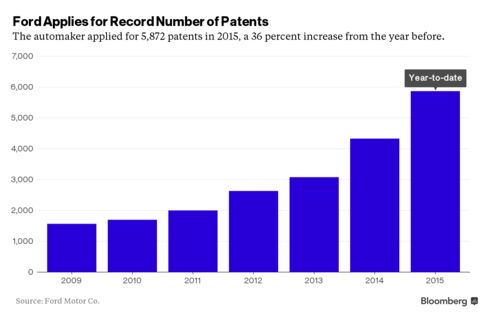

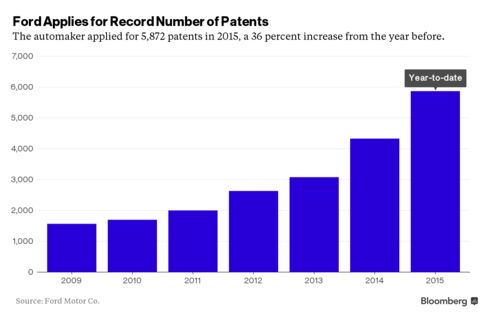

Ford, the 112-year-old automaker, has sought a record number of patents in 2015 as CEO Mark Fields pushes the company toward Silicon Valley-style innovation. The company applied for 5872 patents so far this year, a 36% increase from all of 2014, in areas including autonomous cars, wearable devices & ride-sharing. Ford said its filings related to electrified vehicles have almost tripled in the past 5 years, including more than 400 last year.

“We’re getting innovation not just from the major centers we’ve had historically in Michigan and in Europe, but really the entire enterprise is becoming more inventive,” Bill Coughlin, CEO of Ford Global Technologies, said. “Once someone starts thinking like an inventor, they can’t turn that off,” he said, adding that “it changes your mindset more toward one that would be very familiar in Silicon Valley.” Fields has repeatedly said he wants Ford to be part of Silicon Valley as it pushes further into new businesses such as driverless cars & electrified vehicles. The company said earlier this month that it will invest $4.5B in electrified autos by 2020, after stepping up its autonomous-vehicle efforts. Ford also has 275 US patents on its EcoBoost engines, more than any other automaker for gasoline turbocharged direct-injection technology, & an additional 200 pending. As of Nov, 1K patent applications from this year have been approved while the rest are in the process. The stock rose 47¢. If you would like to learn more about Ford, click on this link:

club.ino.com/trend/analysis/stock/F?a_aid=CD3289&a_bid=6ae5b6f7

There was nothing special today in the stock market. Price swings at this time of year are part of year-end trading when numerous buy & sell orders are placed to make balance sheets look better. Tomorrow will be a full day of trading & Thurs a ½ day of trading.

Dow Jones Industrials

AMJ (Alerian MLP Index tracking fund)

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif?0.17568512086796462)

Royal Dutch Shell cut its planned capital spending for 2016 by $2B, to $33B, continuing to cope with low oil prices as it moves to complete its acquisition of BG Group early next year The spending announcement came as the Anglo-Dutch oil company published several key documents in preparation for the main remaining hurdle to the deal: a shareholder vote. In the months since the deal was announced, some investors have expressed concerns about its cost in the face of tumbling oil prices, an issue RDS-B management has been at pains to address. Shell has already taken action to cut costs & reduce spending this year by $12B. "The combination with BG represents a tremendous opportunity to create value for both sets of shareholders, particularly in deep water and [liquefied natural gas]," Shell CEO said. It is "a strong platform to refocus the company, to create a simpler & more competitive Shell." Shell said the tie-up would bolster its position in liquefied natural gas & offshore Brazil, boosting its production & providing it with a clear focus for the coming years. The company expects the deal to enhance its ability to cover investment & divs in "any reasonably expected oil-price environment." Shell estimated that the long-term oil price needed for the deal to break even is in the low-$60s-a-barrel range. Though well above the current price, few expect oil to remain at its current weak levels in the years ahead. The company expects the deal to contribute to its cash flow from operations next year if benchmark Brent crude, now around $36 a barrel, trades at $50 or higher. Shell valued the cash-&-share deal at $53B last week, a sharp decrease compared with the $70B price tag when first announced in Apr. Shell & BG will hold meetings on in late Jan for shareholders approval & the deal could complete by Feb 15. RDS-B stock rose 1.02. If you would like to learn more about RDS-B, click on this link:

club.ino.com/trend/analysis/stock/RDS.B?a_aid=CD3289&a_bid=6ae5b6f7

Shell Lowers 2016 Capital-Spending Plan

Royal Dutch Shell (RDS.B)

Nike, a Dow, stock hovered near its all-time high as executives prepared to announce earnings for its fiscal Q2 of 2016. Analysts expect the to meet expectations of another strong performance & remain on track to hit its target of $50B in revenue by 2020. NKE is projected to post EPS of 86¢, an increase of 16% from the same period one year ago, on quarterly revenue of $7.8B. Revenue is expected to rise 5.8% from the 2nd fiscal qtr of 2015. The company has beaten analyst earnings estimates for 13 straight qtrs. NKE has been the best-performing stock in the Dow Jones for 2015, posting a 35% gain. The stock rose 2.05. If you would like to learn more about NKE, click on this link:

club.ino.com/trend/analysis/stock/NKE?a_aid=CD3289&a_bid=6ae5b6f7

Nike Running Strong Ahead of 2Q Earnings Results

Nike (NKE)

Ford, the 112-year-old automaker, has sought a record number of patents in 2015 as CEO Mark Fields pushes the company toward Silicon Valley-style innovation. The company applied for 5872 patents so far this year, a 36% increase from all of 2014, in areas including autonomous cars, wearable devices & ride-sharing. Ford said its filings related to electrified vehicles have almost tripled in the past 5 years, including more than 400 last year.

“We’re getting innovation not just from the major centers we’ve had historically in Michigan and in Europe, but really the entire enterprise is becoming more inventive,” Bill Coughlin, CEO of Ford Global Technologies, said. “Once someone starts thinking like an inventor, they can’t turn that off,” he said, adding that “it changes your mindset more toward one that would be very familiar in Silicon Valley.” Fields has repeatedly said he wants Ford to be part of Silicon Valley as it pushes further into new businesses such as driverless cars & electrified vehicles. The company said earlier this month that it will invest $4.5B in electrified autos by 2020, after stepping up its autonomous-vehicle efforts. Ford also has 275 US patents on its EcoBoost engines, more than any other automaker for gasoline turbocharged direct-injection technology, & an additional 200 pending. As of Nov, 1K patent applications from this year have been approved while the rest are in the process. The stock rose 47¢. If you would like to learn more about Ford, click on this link:

club.ino.com/trend/analysis/stock/F?a_aid=CD3289&a_bid=6ae5b6f7

Ford Applies for Record Number of Patents as CEO Eyes Innovation

Ford (F)

There was nothing special today in the stock market. Price swings at this time of year are part of year-end trading when numerous buy & sell orders are placed to make balance sheets look better. Tomorrow will be a full day of trading & Thurs a ½ day of trading.

Dow Jones Industrials

No comments:

Post a Comment