Dow fell 53, decliners over advancers 3-2 & NAZ went down 9. The MLP index went down a fraction to 310 & the REIT index was up fractionally to the 362s. Junk bond funds inched higher & Treasuries were steady. Oil dropped under 45 & gold fell back to 1311.

AMJ (Alerian MLP Index tracking fund)

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif?0.5516087415248782)

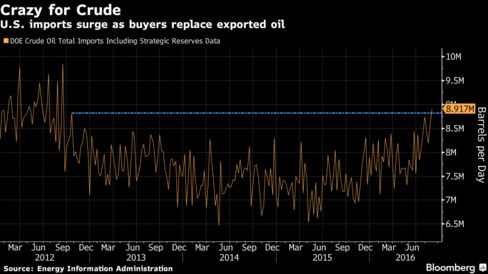

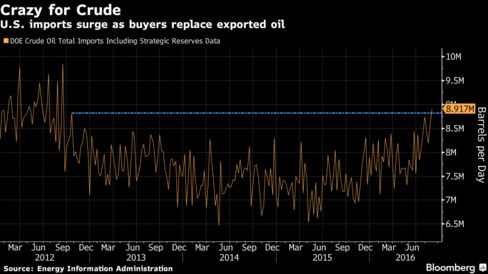

US. last week imported 8.92M barrels a day of crude, the largest amount in almost four years, according to preliminary data from the Energy Information Administration.

Minneapolis Fed pres Neel Kashkari said he is looking for core inflation to tick up before the central bank raises interest rates. "I'm very interested to see core inflation," Kashkari said. "We haven't seen it yet. That's what I'm looking for." He is not a voting member of the Fed's policy committee this year.

A measure of homes under contract for sale rose in Jul, a sign of steady demand amid low interest rates & rising employment. The National Association of Realtors' pending home sales index, which tracks contract signings for purchases of previously owned homes, increased a seasonally adjusted 1.3% to 111.3 in Jul. Sales then typically close within a month or 2 of signings. The forecast expected a 0.7% rise. The index had registered at a downwardly revised 109.9 in Jun after reaching a post-housing bust peak of 115.0 in Apr & now sits at the 2nd-highest level of 2016. The Jul reading was 1.4% above its year-ago level. "More home shoppers having success is good news for the housing market heading into the fall, but buyers still have few choices and little time before deciding to make an offer on a home available for sale," said Lawrence Yun, NAR's chief economist. Pending sales were up across most of the country but fell in the Midwest. The housing market has been a relative bright spot in the economy in recent years, though it has shown signs of cooling amid high prices & tight inventories. Last week, the Realtors group reported that the pace of existing-home sales fell 3.2% last month from Jun to a seasonally adjusted annual rate of 5.39M. "There's little doubt there'd be more sales activity right now if there were more affordable listings on the market," the NAR said. Low mortgage rates & continued job creation are luring more would-be buyers into the market.

Gold futures settled lower, helping push the precious metal to its first monthly decline since May, underscoring a broad slide in the metals complex in Aug. Gold for Dec fell $5.10 (0.4%) to settle at $1311 an ounce, for a 3.4% decline in the month of Aug. Silver's most-active contract dropped 8.1%. Similarly, prices for copper, platinum & palladium all declined over Aug.

Aug was an uneventful month for the stock market, as usual. Dow was up a little in the month due to a strong performance in the first week. However oil had a very volatile month & gold pulled back. Next week, traders will return, bringing more excitement to the markets.

Dow Jones Industrials

AMJ (Alerian MLP Index tracking fund)

Crude Oil Oct 16

![Live 24 hours gold chart [Kitco Inc.]](http://www.kitco.com/images/live/gold.gif?0.5516087415248782)

US. last week imported 8.92M barrels a day of crude, the largest amount in almost four years, according to preliminary data from the Energy Information Administration.

U.S. Crude Imports Soar to Highest Since September 2012

Minneapolis Fed pres Neel Kashkari said he is looking for core inflation to tick up before the central bank raises interest rates. "I'm very interested to see core inflation," Kashkari said. "We haven't seen it yet. That's what I'm looking for." He is not a voting member of the Fed's policy committee this year.

Fed's Kashkari Wants To See Core Inflation Rise Before Any Rate Hike

A measure of homes under contract for sale rose in Jul, a sign of steady demand amid low interest rates & rising employment. The National Association of Realtors' pending home sales index, which tracks contract signings for purchases of previously owned homes, increased a seasonally adjusted 1.3% to 111.3 in Jul. Sales then typically close within a month or 2 of signings. The forecast expected a 0.7% rise. The index had registered at a downwardly revised 109.9 in Jun after reaching a post-housing bust peak of 115.0 in Apr & now sits at the 2nd-highest level of 2016. The Jul reading was 1.4% above its year-ago level. "More home shoppers having success is good news for the housing market heading into the fall, but buyers still have few choices and little time before deciding to make an offer on a home available for sale," said Lawrence Yun, NAR's chief economist. Pending sales were up across most of the country but fell in the Midwest. The housing market has been a relative bright spot in the economy in recent years, though it has shown signs of cooling amid high prices & tight inventories. Last week, the Realtors group reported that the pace of existing-home sales fell 3.2% last month from Jun to a seasonally adjusted annual rate of 5.39M. "There's little doubt there'd be more sales activity right now if there were more affordable listings on the market," the NAR said. Low mortgage rates & continued job creation are luring more would-be buyers into the market.

July Pending Home Sales Rise 1.3%

Gold futures settled lower, helping push the precious metal to its first monthly decline since May, underscoring a broad slide in the metals complex in Aug. Gold for Dec fell $5.10 (0.4%) to settle at $1311 an ounce, for a 3.4% decline in the month of Aug. Silver's most-active contract dropped 8.1%. Similarly, prices for copper, platinum & palladium all declined over Aug.

Gold Declines 0.4%, Sealing First Monthly Loss Since May

Aug was an uneventful month for the stock market, as usual. Dow was up a little in the month due to a strong performance in the first week. However oil had a very volatile month & gold pulled back. Next week, traders will return, bringing more excitement to the markets.

Dow Jones Industrials